Proctor who has helped hundreds of organizations qualify for the classification. Find tax information for charitable organizations including exemption requirements the application for recognition of exemption required filings and more.

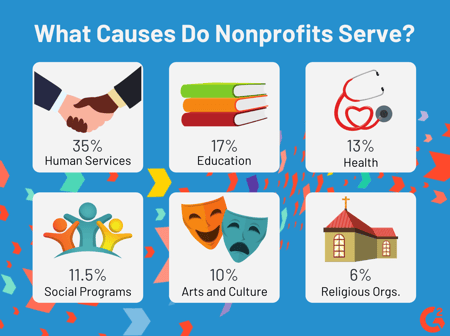

What Are The Different Types Of Nonprofits

What Are The Different Types Of Nonprofits

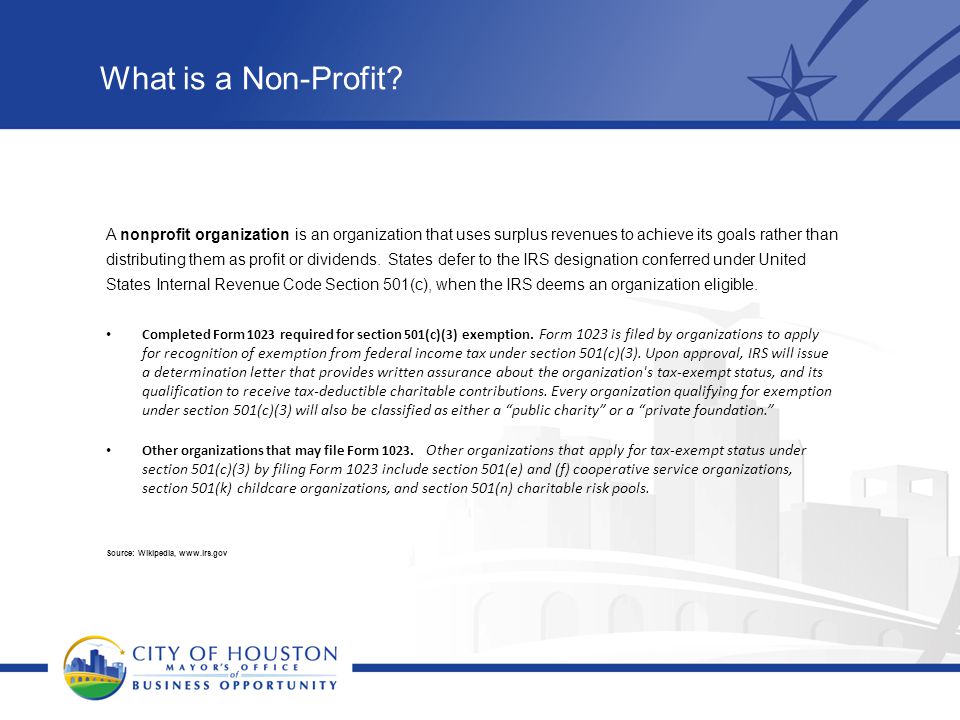

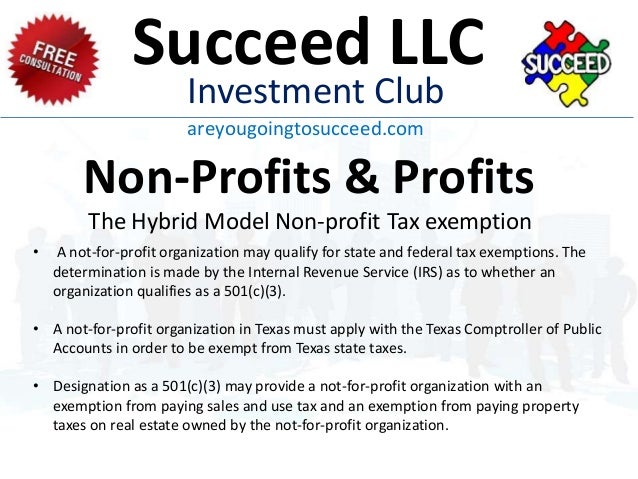

The 501 c designation is an IRS tax code designation for a non-profit organization that receives some exemption from federal taxation.

Non profit designation. 1 Also there are several more 501 nonprofit types with various designations such as 501K and 501N which are also tax-exempt. While each nonprofit designation is exempt from paying most federal income tax each type has its own rules concerning eligibility lobbying electioneering and whether contributions or donations qualify as tax deductible. The Definition of Nonprofit The term is meant to describe a nonprofit organization not operating primarily to make a profit.

People use the term nonprofit to describe all of the different types of NPOs and NFPOs widely. The program teaches best practices on critical skills and topics specific to nonprofit organizations and attendees are able to apply their new knowledge to benefit their organizations right away. An organization exempt under a subsection of Code sec.

Beyond the basic IRS distinction each type of nonprofit entity has some distinctions in terms of business operations finance staffing board governance and programs. 501 c designations are for specific types of tax-exempt nonprofit organizations. 2 All 501s are to one degree or another.

A nationally-recognized CNAP designation certifies the expertise and commitment of nonprofit financial managers and accounting professionals. 501 other than 501 c 3 may establish a charitable fund contributions to which are deductible. A nonprofit designation and tax-exempt status are given only to organizations that further religious scientific charitable educational literary public safety or cruelty-prevention causes or.

A nonprofit organization is formed for charitable educational religious scientific community development or other socially beneficial purposes. IRS Publication 557 provides detailed information about the various rules and regulations surrounding each nonprofit designation. To be tax-exempt under section 501c3 of the Internal Revenue Code an organization must be organized and operated exclusively for exempt purposes set forth in section 501c3 and none of its earnings may inure to any private shareholder or individual.

Within this group there are many different designations of nonprofit determined by the IRS through its tax-exempt rulings. Still 501 c 3 is the designation most nonprofits seek and for good reason according to Dr. Registering as a 501 c organization allows nonprofits to be exempt from some federal taxes.

In addition it may not be an action organization ie it may not attempt to influence legislation as a substantial part of its. Cash in your nonprofit can be seen as belonging to one of three pools. This designation appears in Title 26 Subtitle A Chapter 1 Subchapter F Section 501 of the Internal Revenue Code.

The IRS recognizes 27 types of nonprofit organizations as 501 c organizations. State taxation generally follows the same criteria as the federal government for tax exemption. Nonprofit Designation List Benevolent Fund donors have the option of giving an undesignated gift to allow the Fund flexibility in operating its Employee Emergency Assistance Program providing annual grants to local nonprofits not included within the Funds designation list and hosting projects like the campus wide Habitat for Humanity build.

The board can choose to change the designated purpose or to undesignate the cash. While nonprofit corporations are the most popular form of organization for nonprofit activities unincorporated associations or trusts are also options to consider. For example they could designate funds to be set aside as a rainy day reserve fund.

WHAT IS A NONPROFIT ORGANIZATION. Designated cash is still unrestricted cash. As nonprofits already know this designation has to be protected through accurate reporting and proper management to.

Such a fund must itself meet the requirements of section 501 c 3 and the related notice requirements of section 508 a. Instead it an organization whose mission focuses on furthering a social cause or a shared goal or mission. Its a little different than other 501 c classifications because your contributions and donations are tax deductible he said.

What Is A Nonprofit Organization And How Is It Different From A Charity

What Is A Nonprofit Organization And How Is It Different From A Charity

Document Management Systems For Non Profit Organizations Ppt Download

Document Management Systems For Non Profit Organizations Ppt Download

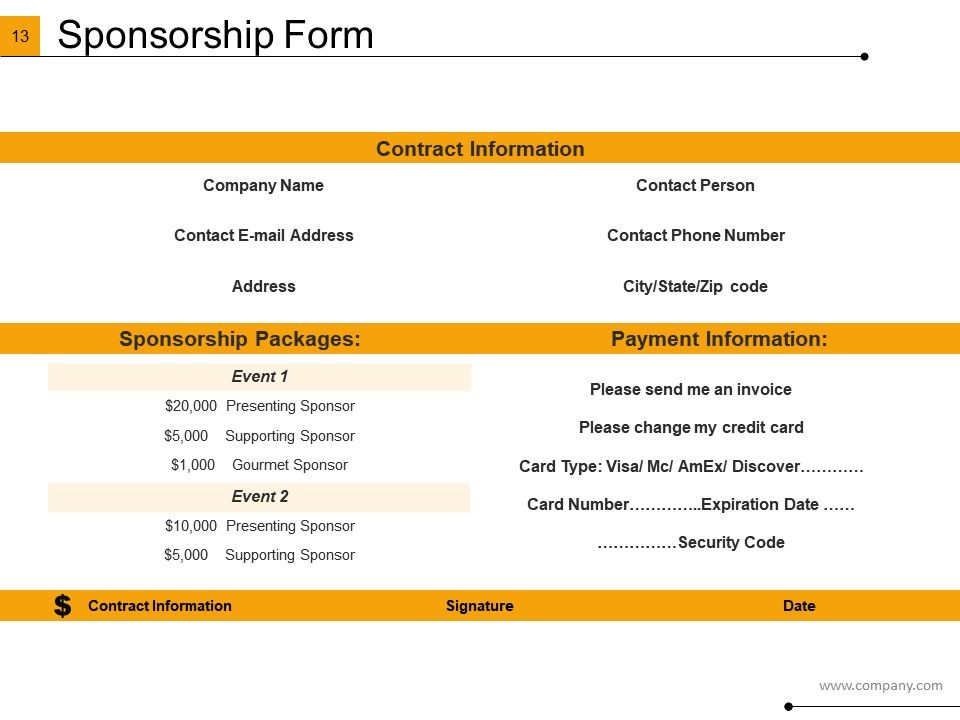

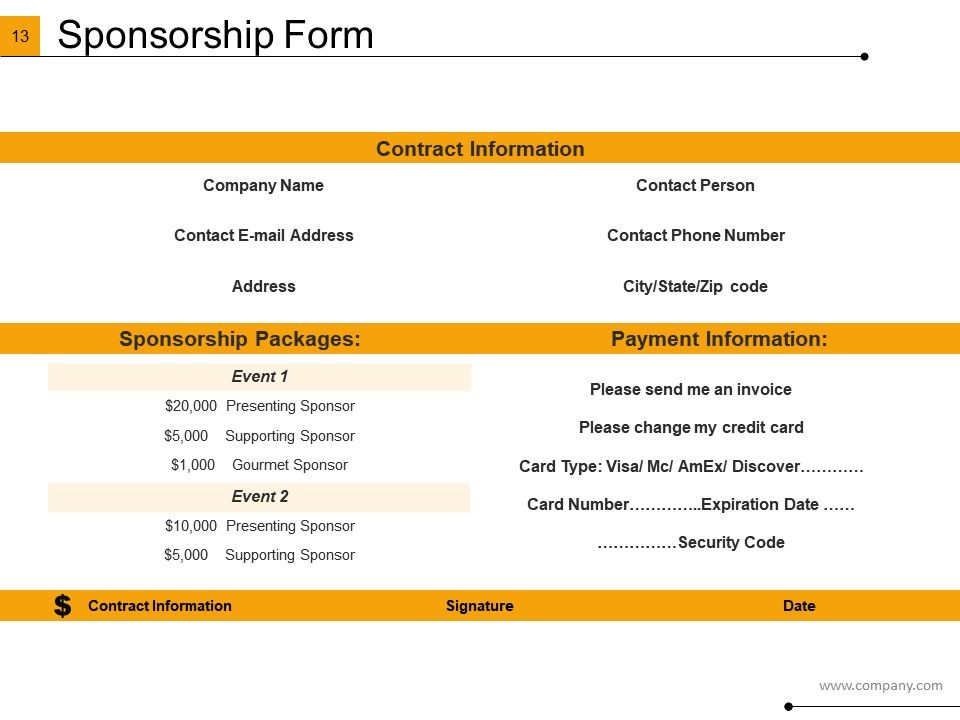

Sponsorship Proposal For Nonprofit Organization Powerpoint Presentation Slide Template Presentation Sample Of Ppt Presentation Presentation Background Images

Sponsorship Proposal For Nonprofit Organization Powerpoint Presentation Slide Template Presentation Sample Of Ppt Presentation Presentation Background Images

Non Profit Organization Project Proposal Powerpoint Presentation Slides Templates Powerpoint Slides Ppt Presentation Backgrounds Backgrounds Presentation Themes

Non Profit Organization Project Proposal Powerpoint Presentation Slides Templates Powerpoint Slides Ppt Presentation Backgrounds Backgrounds Presentation Themes

Non Profit Organization Project Proposal Powerpoint Presentation Slid

Non Profit Organization Project Proposal Powerpoint Presentation Slid

Sponsorship Proposal For Nonprofit Organization Powerpoint Presentation Slide Template Presentation Sample Of Ppt Presentation Presentation Background Images

Sponsorship Proposal For Nonprofit Organization Powerpoint Presentation Slide Template Presentation Sample Of Ppt Presentation Presentation Background Images

Nonprofit Journalism Funding Surviving And Thriving

Nonprofit Journalism Funding Surviving And Thriving

Starting A Non Profit Organization And Business Ppt Video Online Download

Starting A Non Profit Organization And Business Ppt Video Online Download

10 Easy Steps To Start A Nonprofit Organization Explainer Video

10 Easy Steps To Start A Nonprofit Organization Explainer Video

What Is A Nonprofit Organization Definition And Meaning Market Business News

What Is A Nonprofit Organization Definition And Meaning Market Business News

Four Reasons The Nonprofit Sector Needs A New Name Onn

Four Reasons The Nonprofit Sector Needs A New Name Onn

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Tidak ada komentar:

Posting Komentar

Catatan: Hanya anggota dari blog ini yang dapat mengirim komentar.