As of 2016 taxes accounted for almost half of the retail cost of a pack of cigarettes. Some localities have an additional excise tax on top of the state tax.

Federal And State Cigarette Excise Taxes United States 1995 2009

Federal And State Cigarette Excise Taxes United States 1995 2009

The government is also proposing to increase the tax on tobacco products by 4 per carton of 200 cigarettes.

Federal cigarette tax. It doesnt stop thereit also would establish an excise tax equity among all tobacco product tax rates including those relating to roll-your-own pipe smokeless discrete single-use unit those containing made from derived from tobacco or nicotine that isnt intended to be smoked and is in the form of a lozenge tablet pill pouch dissolvable strip and both small and large cigars. Effects on health and the federal budget. Recent federal law changes raised the minimum age for tobacco products to 21 which effectively shrinks the tax base.

At the same time e-cigarettes and vape products remain in the spotlight and may inspire other states to adopt new taxes on these products. The forecast predicts a decrease in tobacco tax revenues down to 1155 billion US. On average states charge 173 of taxes per pack of 20 cigarettes.

In recent years almost every state and the federal government have increased tobacco taxes. The 2012 long-term budget outlook. The federal cigarette tax increased by 62 cents to 101 per pack on April 1 2009 with increases in other tobacco taxes.

Raja Krishnamoorthi D-Ill and seven other senate Democrats backed the Tobacco Tax Equity Act. A tobacco or cigarette tax is a tax imposed on all tobacco products by various levels of government often with the alleged goal of reducing tobacco use. In 2019 revenues from tobacco tax amounted to 1246 billion US.

Its estimated this tax would boost federal revenues by more than 21 billion over. Congressional Budget Office June 2012. States had followed suit.

On April 1 2009 the federal cigarette tax increased by 62 cents to 101 per pack. As of March 14 2021 the average state cigarette tax is 191 per pack. Background Both the federal government and state governments tax tobacco products.

Senate Majority Whip Dick Durbin D-Ill and Senate Finance Committee Chair Ron Wyden D-Ore along with US. Revenues are likely to fluctuate in 2020. When calculated per pack of 20 cigarettes this is 10066 per pack.

WASHINGTON Democratson Thursday introduced a bill to establish the first federal e-cigarette tax and increase the tobacco tax rate for the first time in a decade. 52 rows States arent the only jurisdictions that levy excise taxes on cigarettes and. 58 rows The federal tax of 5033 for cigarettes is levied per 1000 cigarettes.

The increases were part of legislation expanding coverage under the State Childrens Health Insurance Program SCHIP. In 2018 the federal excise tax on cigarettes was just under 101 per pack and the average state excise tax on cigarettes was 175 per pack. In addition settlements that the major tobacco manufacturers reached with state attorneys general in 1998 require the manufacturers to pay about 60 cents per.

In 2005 state-level cigarette taxes ranged from 7 cents per pack in South Carolina to 246 per pack in Rhode Island. Raising the excise tax on cigarettes. The nations first state-level cigarette excise tax was enacted in Iowa in 1921.

Cigarette taxes around the country are levied on top of the federal rate of 10066 per 20-pack of cigarettes. Childrens Health Insurance Program Reauthorization Act of 2009. The Tobacco Tax Equity Act of 2021 aims to close tax code loopholes for tobacco products by increasing the federal tax rate on cigarettes pegging it to inflation to ensure it remains an.

In 2005 the federal cigarette tax stood at 37 cents per pack. By 1969 all 50 US. For this study this fractional tax is referred to as 101 per pack.

When Did Your State Adopt Its Cigarette Tax Tax Foundation

When Did Your State Adopt Its Cigarette Tax Tax Foundation

Increasing The Federal Cigarette Tax A Means Of Reducing Consumption Ncbi Bookshelf

Increasing The Federal Cigarette Tax A Means Of Reducing Consumption Ncbi Bookshelf

Federal And State Cigarette Excise Taxes United States 1995 2009

Federal And State Cigarette Excise Taxes United States 1995 2009

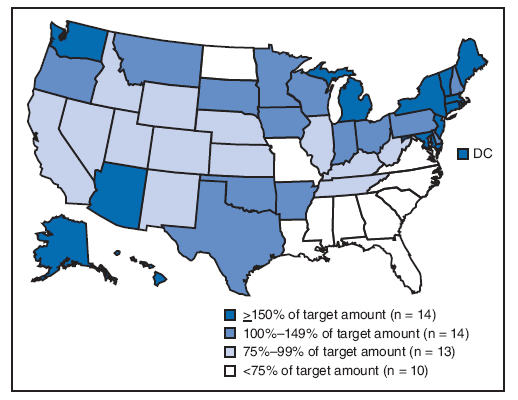

Spatial Distribution Of State And Federal Cigarette Taxes Retail Download Scientific Diagram

Spatial Distribution Of State And Federal Cigarette Taxes Retail Download Scientific Diagram

Tobacco Taxation And Unintended Consequences U S Senate Hearing On Tobacco Taxes Owed Avoided And Evaded Tax Foundation

Tobacco Taxation And Unintended Consequences U S Senate Hearing On Tobacco Taxes Owed Avoided And Evaded Tax Foundation

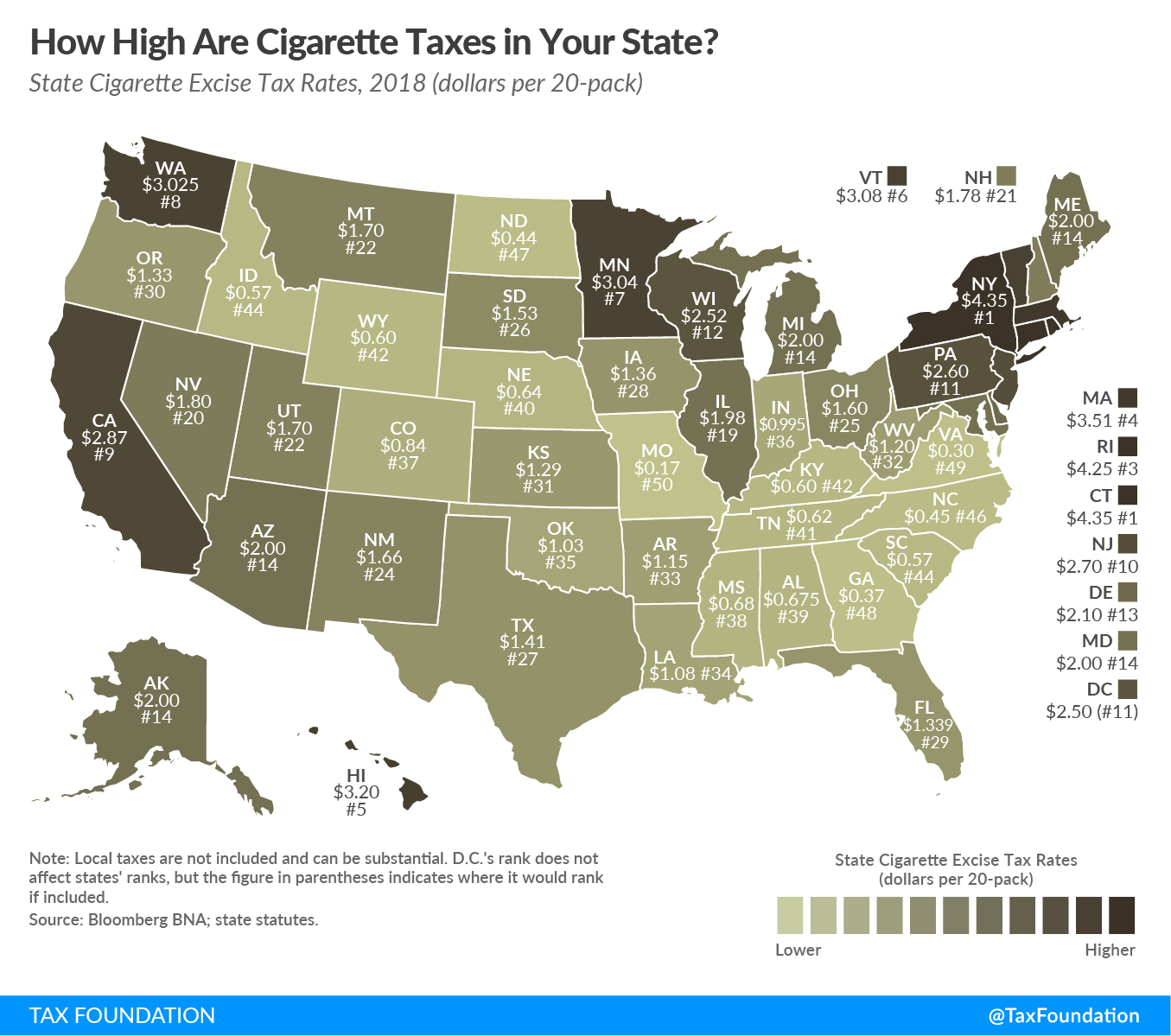

How High Are Cigarette Tax Rates In Your State Tax Foundation

How High Are Cigarette Tax Rates In Your State Tax Foundation

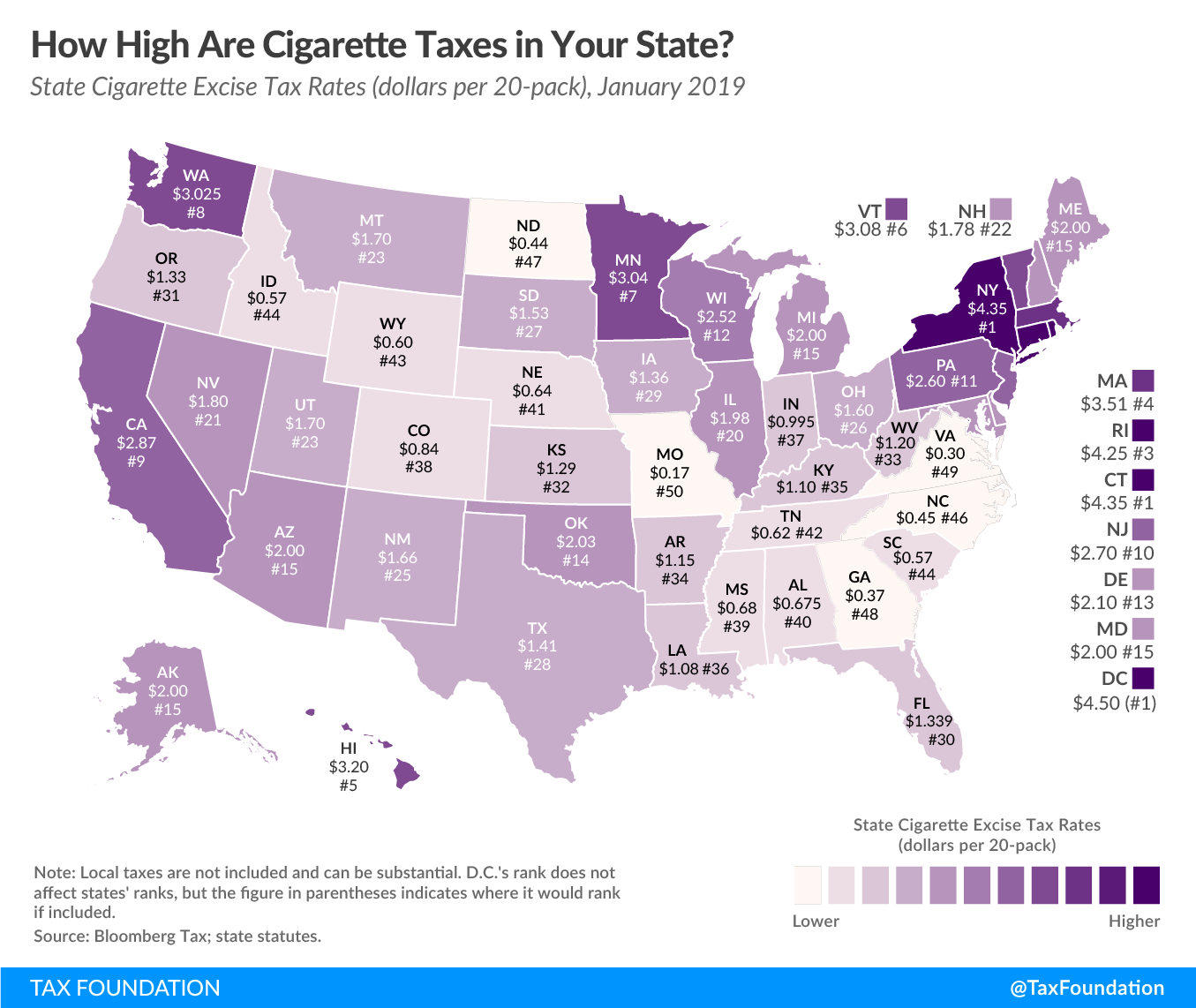

How High Are Cigarette Taxes In Your State 2019 Rankings

How High Are Cigarette Taxes In Your State 2019 Rankings

Real Federal Cigarette Tax Rates And State Cigarette Tax Rates Download Scientific Diagram

Real Federal Cigarette Tax Rates And State Cigarette Tax Rates Download Scientific Diagram

State Cigarette Tax Rates In 2014 Tax Foundation

State Cigarette Tax Rates In 2014 Tax Foundation

Federal Tobacco Tax Revenues Are Declining Tax Foundation

Federal Tobacco Tax Revenues Are Declining Tax Foundation

Real Federal Cigarette Tax Rates And State Cigarette Tax Rates Download Scientific Diagram

Real Federal Cigarette Tax Rates And State Cigarette Tax Rates Download Scientific Diagram

Cigarette Taxes In Photos The Turbotax Blog

Cigarette Taxes In The United States Wikipedia

Cigarette Taxes In The United States Wikipedia

Can We Trust The Philly Cigarette Tax Revenue Projections A Look Inside The Numbers Whyy

Can We Trust The Philly Cigarette Tax Revenue Projections A Look Inside The Numbers Whyy

Tidak ada komentar:

Posting Komentar

Catatan: Hanya anggota dari blog ini yang dapat mengirim komentar.