Percentage of Federal Credit. States typically set their credits as a percentage of the federal EITC.

What Is The Earned Income Tax Credit Tax Policy Center

What Is The Earned Income Tax Credit Tax Policy Center

In 2020 28 states and the District of Columbia offer their own EITC typically calculated as a percentage of the federal credit.

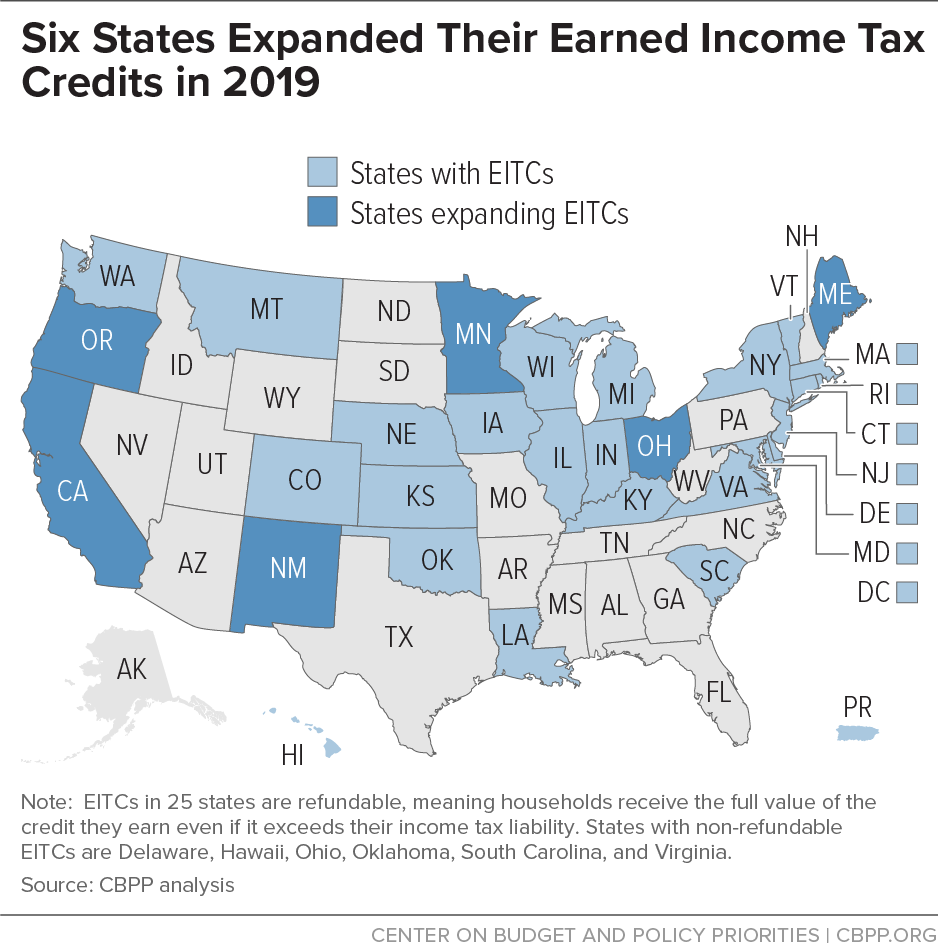

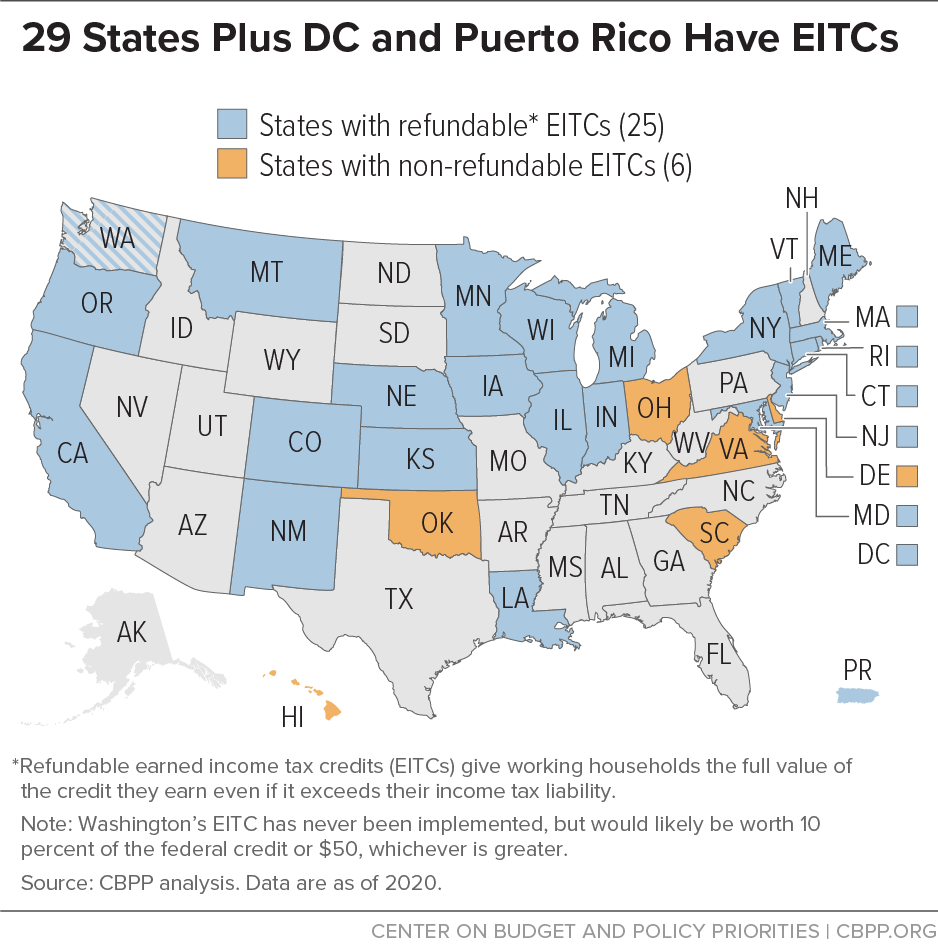

State earned income tax credit. State Earned Income Tax Credits Twenty-nine states plus the District of Columbia and Puerto Rico have enacted their own version of the federal Earned Income Tax Credit EITC to help working families earning low wages meet basic needs. California EITC requires filing of your state return form 540 2EZ or 540 and having earned income reported on a W-2 form ie. The value and administration of the state EITC is determined by each state including whether the state credit is refundable providing a refund to households even in the absence of tax liability.

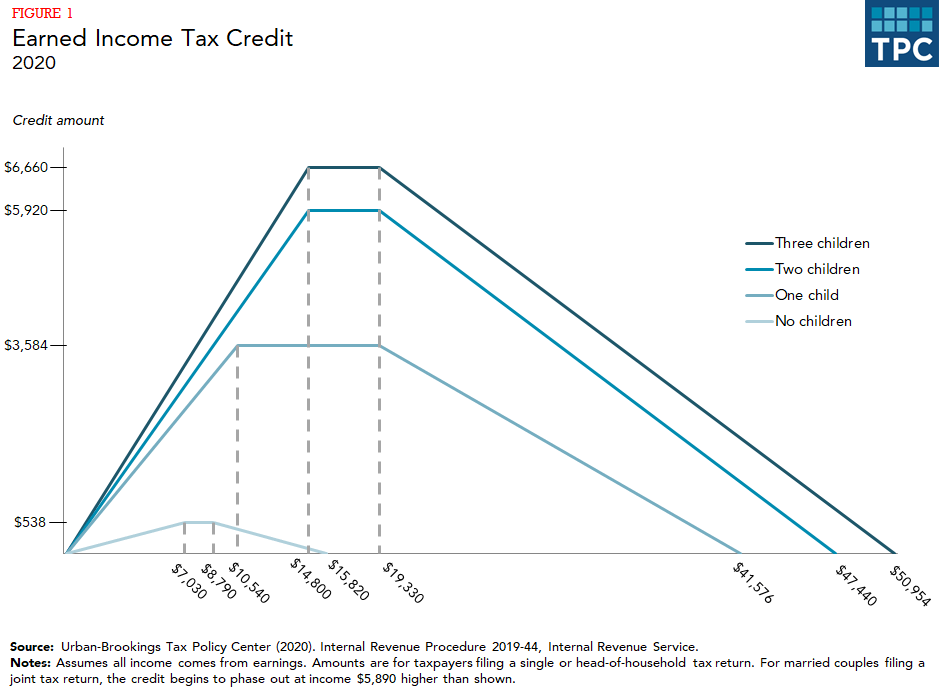

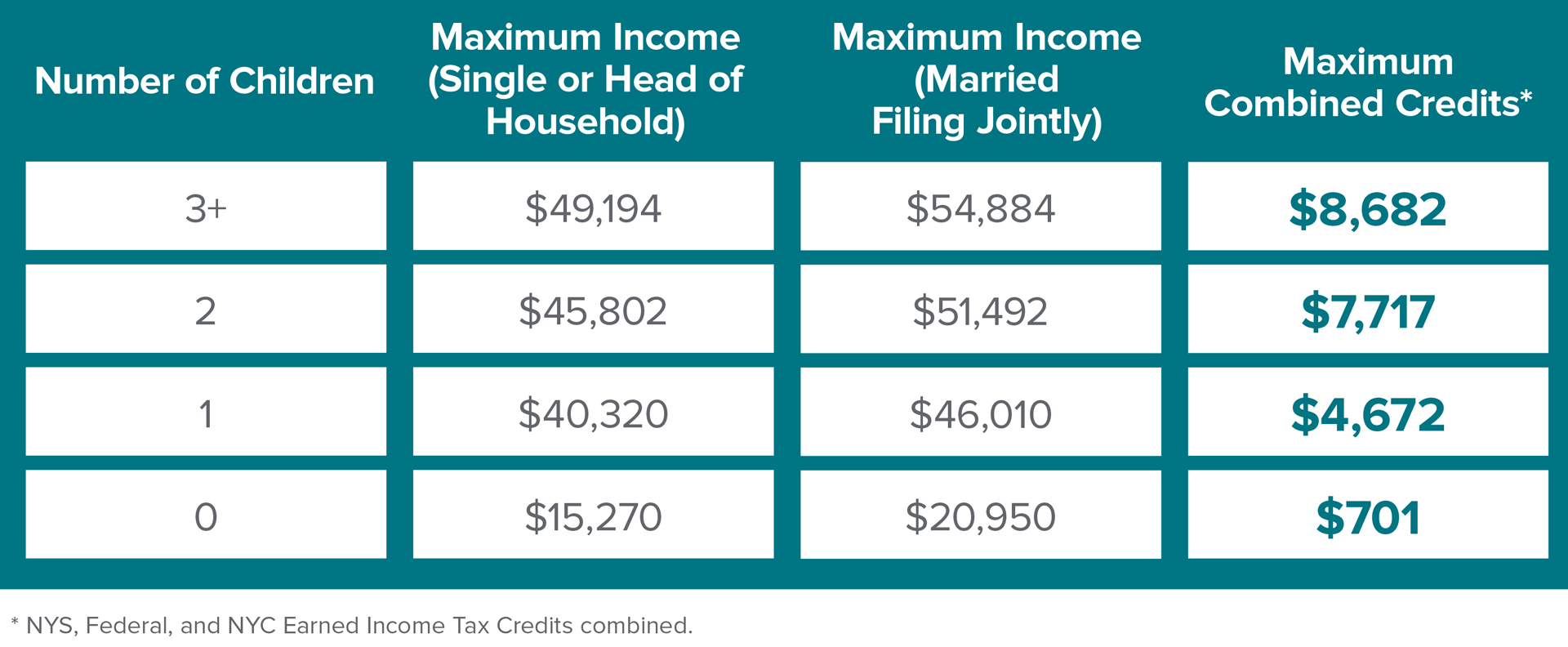

The Earned Income Tax Credit EITC is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The EITC includes credits from the federal government New York State and New York Cityworth up to a total of 8991 for a family. This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020.

33 rows States and Local Governments with Earned Income Tax Credit. Most states with state EITCs set their benefit as a percentage of the federal credit making them easy to administer. In 2020 28 states and the District of Columbia offered their own earned income tax credit EITC.

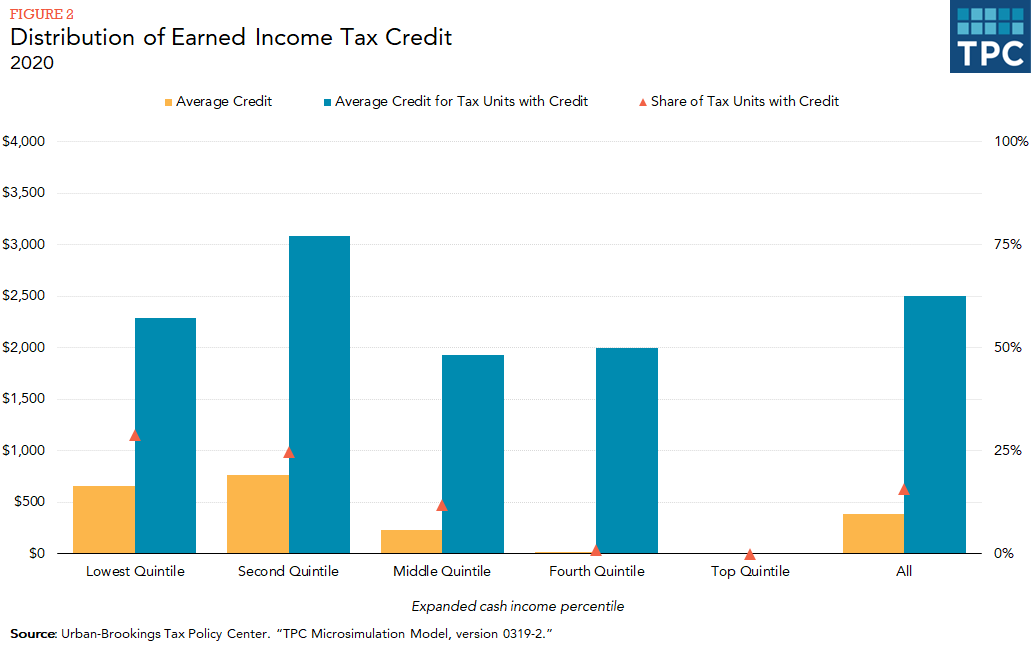

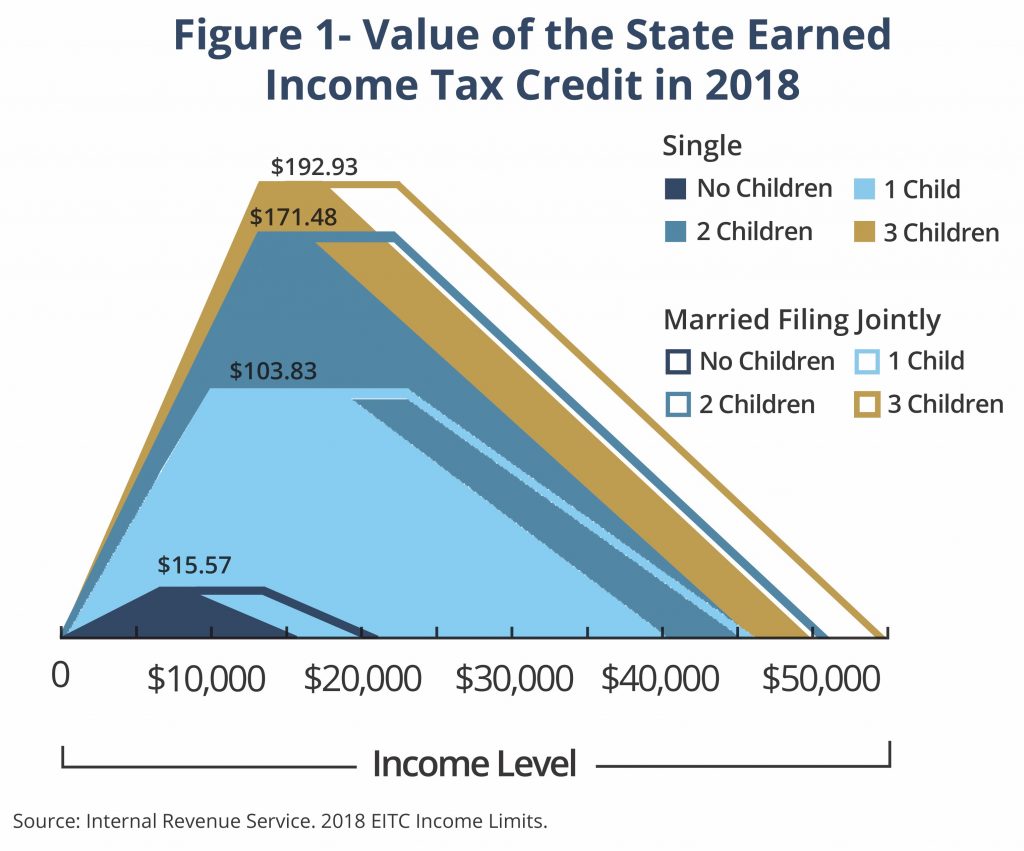

In 2019 25 million taxpayers received about 63 billion in earned income credits. State or Local Government. The state earned income tax credit EITC is a tax credit for low-income working individuals typically calculated as a percentage of the federal EITC.

The earned income tax credit EITC is a refundable tax credit designed to provide relief for low-to-moderate-income working people. If you are eligible this could be the largest tax credit you can receivea significant boost that arrives with your refund. The value and administration of the state credit is determined by each state.

In 2021 more hard-working individuals and families are eligible than ever including Californians that file their taxes with. Rewarding Work Through State Earned Income Tax Credits. The California Earned Income Tax Credit CalEITC is a refundable cash back tax credit for qualified low-to-moderate income Californians.

This year the EITC is getting a second look from taxpayers because many have experienced income changes due to COVID-19. With tax season on the way dont miss out on the Earned Income Tax Credit EITC. The Earned Income Tax Credit EIC or EITC is a refundable tax credit for low- and moderate-income workers.

State Earned Income Tax Credits. Wages salaries and tips subject to California withholding. To figure the credit see Publication 596 Earned Income Credit.

Self-employment income cannot be used to qualify for state credit. However unlike the federal credit some state EITCs are not refundable which makes them much less valuable to very low-income families who rarely owe income tax. Social policies that strengthen the economic security of low-income families such as the Earned Income Tax Credit EITC may reduce child maltreatment by impeding the pathways through which poverty leads to it.

State Earned Income Tax Credits In addition to the federal EITC state-level EITCs can make more money available to lower-income workers while demonstrating a states commitment to reducing poverty among working families. The earned income tax credit EITC was first enacted in 1975 to provide financial assistance to working families with children. The state earned income tax credit EITC is a tax credit for low-income workers typically calculated as a percentage of the federal EITC.

The EITC refunds are not counted as income when your CalWorks CalFresh or Medi-Cal. State and Local Backgrounders Homepage. In 2021 the earned income credit.

The federal earned income tax credit EITC provides a refundable credit to taxpayers based on their income and family circumstances such as marital status and number of children. State Earned Income Tax Credits Policy Basics. Earned Income Tax Credit EITC Relief If your earned income was higher in 2019 than in 2020 you can use the 2019 amount to figure your EITC for 2020.

What Is The Earned Income Tax Credit Tax Policy Center

What Is The Earned Income Tax Credit Tax Policy Center

Eitc A State Tax Credit For Working Families North Carolina Justice Center

Eitc A State Tax Credit For Working Families North Carolina Justice Center

Earned Income Tax Credit Overview

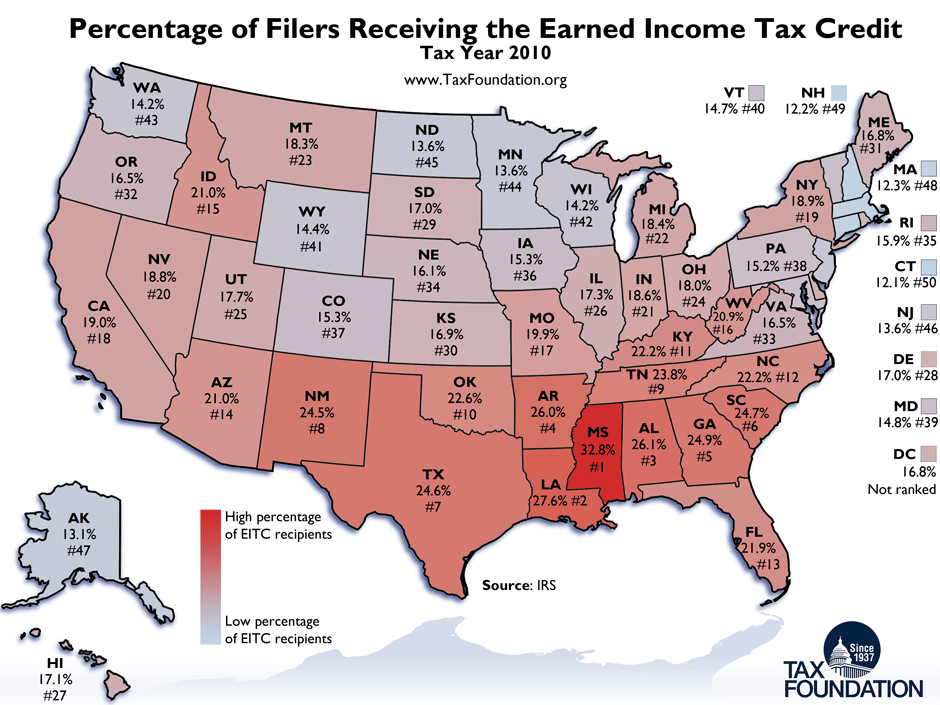

Monday Map Eitc Recipients By State Tax Foundation

Monday Map Eitc Recipients By State Tax Foundation

Percentage Of Filers Claiming The Earned Income Tax Credit In The States Tax Foundation

Percentage Of Filers Claiming The Earned Income Tax Credit In The States Tax Foundation

Earned Income Tax Credit Wikipedia

Earned Income Tax Credit Wikipedia

State Earned Income Tax Credits Get It Back Tax Credits For People Who Work

State Earned Income Tax Credits Get It Back Tax Credits For People Who Work

A State Earned Income Tax Credit Helping Montana S Working Families And Economy Montana Budget Policy Center

A State Earned Income Tax Credit Helping Montana S Working Families And Economy Montana Budget Policy Center

Are You One Of The 380 000 Taxpayers Missing Out On Billions In Tax Credits

Are You One Of The 380 000 Taxpayers Missing Out On Billions In Tax Credits

Six States Expanded Their Earned Income Tax Credits In 2019 Center On Budget And Policy Priorities

Six States Expanded Their Earned Income Tax Credits In 2019 Center On Budget And Policy Priorities

Earned Income Tax Credit Eitc A Primer Tax Foundation

Earned Income Tax Credit Eitc A Primer Tax Foundation

State Earned Income Tax Credits Urban Institute

State Earned Income Tax Credits Urban Institute

Policy Basics State Earned Income Tax Credits Center On Budget And Policy Priorities

Policy Basics State Earned Income Tax Credits Center On Budget And Policy Priorities

State Earned Income Tax Credit Official Website Assemblymember Laura Friedman Representing The 43rd California Assembly District

State Earned Income Tax Credit Official Website Assemblymember Laura Friedman Representing The 43rd California Assembly District

Tidak ada komentar:

Posting Komentar

Catatan: Hanya anggota dari blog ini yang dapat mengirim komentar.